Top 10 container shipping lines control 80% market capacity

The year 2020 was one of the best periods financially for the container shipping sector with most major companies expected to realise returns above WACC after many years. This has brought to the fore a discussion about possible consolidations in the logistics/3PL businesses in 2021 by carriers with deep pockets.

We believe carriers may opt for more vertical acquisitions because of the following reasons.

- Further horizontal consolidation, i.e., container carrier acquiring another container carrier, in the sector through M&A has been halted, and no major transactions have taken place after 2017.

- Previous consolidations over the years have taken supply out of the market and rationalised the supply-demand imbalance and now offers little scope for further consolidation, which will protect the currently favourable industry dynamic.

- The window of opportunity for more M&A has narrowed with fewer operators to absorb.

- The top 10 ocean carriers now control more than 80% of the total capacity market share, further M&A may draw scrutiny from antitrust regulators.

- In the past, the main driver for acquisitions was the need to establish a presence on routes on which the acquirer had a limited or no presence. For instance, Maersk’s takeover of Hamburg Süd, where the latter’s primary strength on its North-South trade reinforced Maersk’s position in these trades.

1. Ocean carriers start focussing on end-to-end supply solutions

As the container shipping industry is more concentrated and has limited opportunity for gains, the focus has shifted to the value-added services provided around shipping. Major liner companies have identified logistics as their growth drivers that will earn extra returns.

This has pushed large ocean shipping companies towards engaging in M&A with the intent of offering more end-to-end supply-chain services such as inland transportation and freight management.

Maersk competing on multiple segments with forwarders

The group has divested in recent years and spun off some parts of its business while acquiring other businesses to expand its end-to-end supply chain offerings. In 2020, it completed a series of acquisitions to boost its 3PL credentials.

The group not only acquired complementary businesses such as a US-based warehouse and distribution company Performance Team, and brokers KGH Customs and Vandergrift but also invested in businesses such as the German forwarder Forto and the US trucking broker Loadsmart that directly compete with its forwarder customers. Towards the end of the year, Maersk’s parent, A.P. Moller Holding, announced that it will acquire food packaging company Faerch Group.

In addition, Maersk merged Damco Supply Chain Services and Maersk Line’s Ocean Product while phasing out of Safmarine shipping and Damco logistics.

Besides acquiring a few businesses, the group developed two initiatives — an instant pricing product and an internal sales channel — that allows it to compete with multiple segments of the forwarding industry. Many forwarders are now using Maersk Spot, an instant quoting and booking platform unveiled in June 2019.

Maersk Spot has seen further adaptation in the market since then, and at the end of December 2020, it accounted for 51% of spot volumes. The best feature of this platform that attracts third-party providers is that contracts are guaranteed – buyers pay a fee if the cargo is unavailable for shipping, and Maersk is fined if the cargo is rolled over.

CMA CGM made their first move into air cargo industry

Another major carrier that focusses on acquisitions that amplify services, such as its purchase of CEVA in 2019. While the group is already present in the air freight business through its ownership of third-party provider CEVA Logistics, the carrier made its first move into asset-based air cargo in September 2020 when it acquired a 30% stake in long-haul passenger airline Groupe Dubreuil Aéro; the completion of the deal is still pending.

Furthermore, the group has purchased four Airbus A330-200F freighters and created a specialised air freight division named CMA CGM Air Cargo. The move bears similarities to what Amazon.com did five years ago when it launched a private airline to support its rapidly growing e-commerce business.

HMM announced the group will develop beyond container shipping

The South Korean ocean carrier could also join the logistics industry like its peers. In his New Year message, HMM’s CEO stated that the company should move beyond container shipping and develop a substantial logistics business.

Although immediate comparisons were made with rival integrated logistics providers such as Maersk and CMA CGM, HMM has a long way to go. Both Maersk and CMA CGM are global terminal operator and logistics providers. In addition, Maersk even operates its own container factory and controls worldwide tugs and towage operation.

On the other hand, CMA CGM has purchased four freight aircraft and created a specialised air freight division. All these factors suggest that HMM’s rivals are better placed to offer 3PL services with HMM left to cover significant lost ground.

2. Carriers benefit from the financial performance of their logistic divisions in 2020

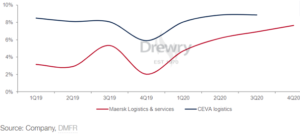

Maersk Logistics & Services had a financially strong year with FY20 revenue increasing by 10% YoY and EBITDA growing more than twice to USD 454mn (FY19:216mn). The full-year EBITDA margin from the segment came in at 6.5% with the performance-driven by a five-fold increase in EBITDA in 4Q20.

It was further supported by higher profitability in intermodal and positive contribution from the integration of Performance Team and KGH in air freight forwarding and warehousing and distribution businesses.

Figure 1: Maersk logistics versus CEVA logistics EBITDA margin development

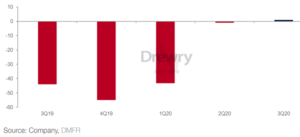

Similarly, CEVA Logistics returned to profitability, booking a profit of USD 1mn in 3Q20. The carrier implemented a new business plan in 2020, which included the development of new products, a network in Africa and Southeast Asia, a digitalisation plan and investment in IT tools with a particular focus on freight management.

The new strategy also included the departure of CEVA CEO Nicolas Sartini. CMA CGM is yet to report is full-year 2020 results.

Figure 2: CEVA logistics net profit / loss (USD mn)

3. Carriers cash position changes investment policy

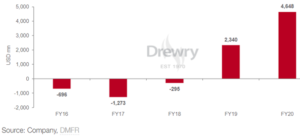

Maersk group is rapidly deleveraging its balance sheet, building equity for future expansion. In 2020, the group repaid USD 1.4bn of debt, taking its leverage ratio to a healthy 1.2x net debt-to- EBITDA (vs 2.1x in FY19), making it by far the strongest containership carrier with the ability to grow both organically and inorganically.

The group has also maintained a disciplined investment strategy. As such, it was able to generate a cash return on invested capital of 16.6% (10.0%), based on strong cash flow from operations, lower gross capex and invested capital compared to 2019.

Maersk accelerate transformation plan

Maersk Group’s net gearing of 30.8% – based on total borrowings and lease liabilities – is still one of the lowest in the industry. Meanwhile, the total net interest-bearing debt decreased to USD 9.2bn. Maersk also has a substantial liquidity reserve of USD 11.0bn, comprising of liquid funds of USD 4.8bn excluding restricted cash and undrawn revolving credit facilities of USD 6.2bn.

While Maersk will update its transformation plan, with metrics for 2020-25 on 11 May 2021 (Capital markets day), its management has indicated that it is preparing an acceleration of its transformation plan. We think the plan would focus more on future verticalization, opportunities and growth.

Figure 3: Free cash flow – Maersk

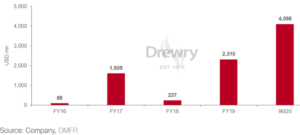

CMA CGM reshuffling debts

In line with its debt reduction strategy, CMA CGM will prepay USD 750mn of various debts by 1Q21. These include the NOL (now CMA CGM Asia Pacific Limited) notes due to mature in 2021. Although the total debt was still high at USD 18.5bn (end September), we expect it to shrink further in the coming quarters with a greater propensity to pay back.

In such a scenario, a strong free cash flow generation and a history of growing inorganically have made CMA CGM a likely candidate to pursue more M&As in the 3PL space.

Figure 4: Free cash flow – CMA CGM

Drewry’s conclusion of the current market circumstances

Large container shipping companies may continue to acquire logistics providers and technology platforms to meet their goal of an end-to-end logistics solutions provider.

For investors in container shipping, we think the developments on the verticalization front have not been properly factored in their share prices as valuations typically focus on the container shipping industry cycles.

While this can be justified to some extent, investors are also sceptical about carriers’ ability to be successful with this strategy. This may soon change in 2021-22 as the positive results from the newly acquired 3PL businesses start impacting the overall financial results.