In August 2020 Mediterranean Shipping Co (MSC) embarked on an epic fleet build-up plan that is expected to result this week with its 200th secondhand ship purchase in less than 22 months, an S&P splurge that is unequalled in the history of shipping. Alphaliner’s latest statistics have MSC at 197 in terms of ships bought since August 2020, but broking sources suggest the Soren Toft-led firm is closing in on a number of more boxship targets.

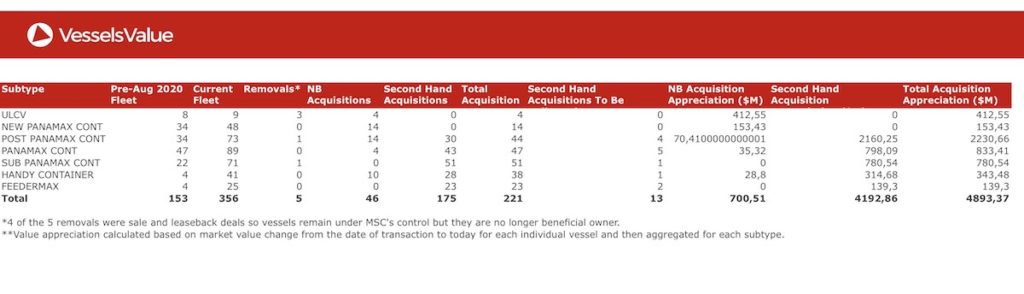

VesselsValue data below shows how MSC’s fleet has appreciated since August 2020 in step with liner shipping’s phenomenal record period of earnings.

At the same time, MSC has been ordering record volumes of newbuilds. MSC, which earlier this year surpassed Maersk at the top of the liner rankings, now has an orderbook of more than 1.7m teu, according to Sea-Intelligence. MSC’s orderbook alone would be the world’s fifth largest carrier, on par with Hapag-Lloyd.

If MSC’s current fleet size is added to its orderbook the combined magnitude is 5.7m teu, the same size Maersk and MSC had in total when they started the 2M alliance just six years ago, analysts at Sea-Intelligence point out.

The dramatic expansion at MSC has seen the company’s founder, Gianluigi Aponte, double his fortune during the pandemic, despite the fact that his cruiseship empire has been badly hit by the global covid outbreak.

Aponte, who turns 82 next month, is now worth $19bn, according to the Bloomberg Billionaires Index.

With its suddenly increased financial strength, MSC has been hunting other acquisition targets. Last month it agreed to buy Bollore’s African transport and logistics business for $6bn. In March it took a stake in Italian ferry operator Moby while earlier in the year it lodged a joint bid with Lufthansa to take over ITA, the successor to Alitalia.

Copyright Splash247.com 2022

By Sam Chambers

Photo: