The volume of crude leaving the Black Sea port of Novorossiysk more than doubled but where is it going?

By Julian Lee (Bloomberg) Asia is still snapping up cheap Russian oil that European buyers don’t want.

Seaborne exports of the nation’s crude rebounded in the seven days to April 22. One-fifth of the volume shipped from ports on the Black Sea, Baltic and Arctic coasts is on tankers showing no final destination, with most expected to end up in Asia.

A total of 40 tankers loaded about 28 million barrels from Russian export terminals, according to vessel-tracking data and port agent reports collated by Bloomberg. That put average seaborne crude flows at 4 million barrels a day, up by 25% against the week ended April 15. The weather played a big part.

The jump in oil exports means a boost to revenues for Moscow as President Vladimir Putin steps up his war in Ukraine, while the U.S. and EU discuss options to wean Europe off Russian oil. At current rates of crude oil export duty, the week’s shipments will have earned the Kremlin about $232 million; that’s $46 million more than the previous week.

Russia exports crude from four main areas: the Baltic Sea in northwest Europe, the Black Sea, the Arctic, and terminals on its Pacific Coast. From three of the four areas, flows to Asia or unknown destinations rose.

The weekly shipment figures can swing depending on the timing of when tankers depart, which is also heavily influenced by the weather at ports — as has been the case for the past several weeks.

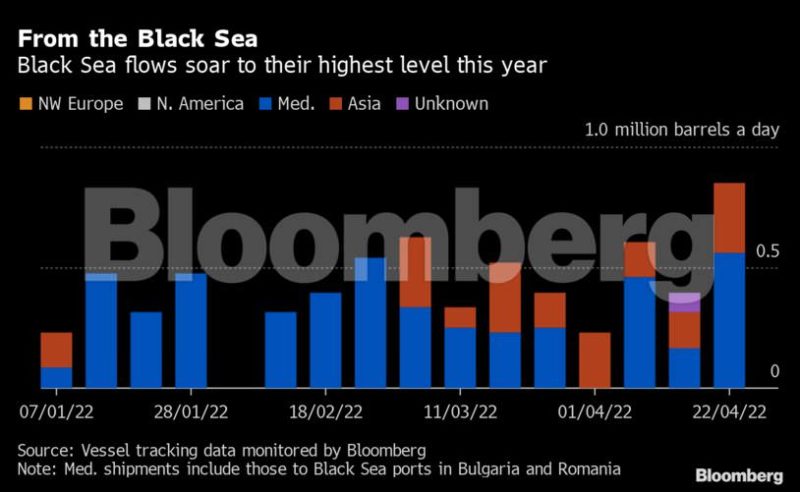

The past week saw higher aggregate volumes from all four regions. Flows of Urals and Siberian Light crude from terminals in the Baltic and Black Sea rose by 663,000 barrels a day, or 36%. The volume of crude leaving the Black Sea port of Novorossiysk more than doubled as a backlog of ships that built up during the previous week’s bad weather started to clear.

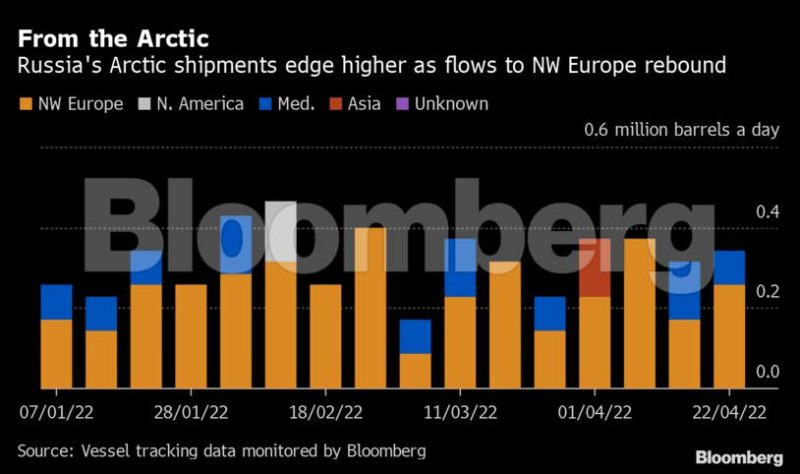

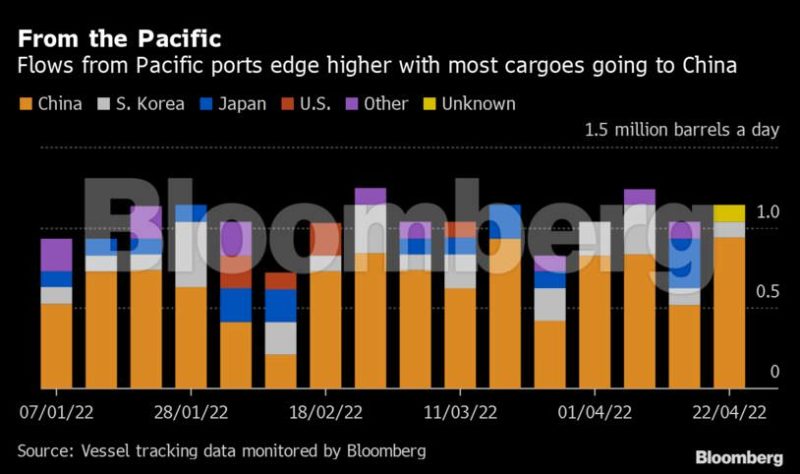

Meanwhile, shipments from the country’s three eastern terminals on its Pacific Ocean coast were up by 105,000 barrels a day, or 10%. Cargoes from Murmansk, which handles crude produced along Russia’s Arctic coastline were also up, increasing by 29,000 barrels a day, or 9%.

This month, Russia’s seaborne crude shipments up to April 22 averaged 3.2 million barrels a day. In full year 2021, they averaged 2.88 million a day.

Related Book: The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources by Javier Blas

U.S. officials and the European Union are in talks over steps the EU could take to restrict oil imports from Russia and cut Moscow’s income from sales. Options include an import ban, a price cap and a payment mechanism to withhold revenue. Russia’s production in the first two weeks of April was down by about 800,000 barrels a day from March.

Also Read: Rotterdam Remains Open To Russia As Port Throughput Falls Just 1.5 Percent

There has been little impact on Moscow’s earnings from crude exports so far. The rebound in crude flows from Russia’s export terminals in the eighth week after the invasion boosted the Kremlin’s export duty revenues by 25% week-on-week.

Crude oil export duty is set at $61.20 a ton in April, equivalent to about $8.30 a barrel. That’s up from $58.30 a ton, $7.95 a barrel, in March and is calculated from an average Urals price over the period from Feb. 15 to March 14. Export duty will fall to $49.60 a ton, $6.81 a barrel, in May.

A gale warning for the Novorossiysk area issued on April 12 halted flows from the terminal for the latter part of that week, with no tankers mooring at the crude oil jetty between April 12 and April 15. The backlog of tankers that built up was slowly being reduced last week, but loadings were still running about six days behind schedule by the end of the week.

The following charts show the destinations of crude cargoes from each of the four export regions. Destinations are based on where vessels signal they are heading at the time of writing, and will almost certainly change as voyages progress.

Russian Black Sea Oil Exports

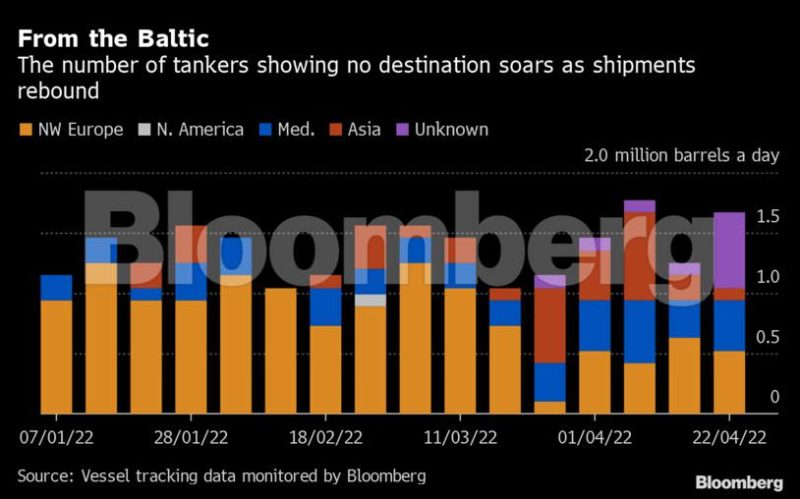

Russian Baltic Exports

Russian Arctic Oil Exports

Russian Pacific Oil Exports

There was a jump in the number of ships loading from the Baltic terminals at Primorsk and Ust-Luga that were showing no destination after their departure. Most are either signaling “For Orders” or Gibraltar. It is very likely that many of those ships will end up either in Asia or they’ll transfer their cargoes to larger vessels, which will continue the journey eastward. However, the number of tankers leaving the Baltic for destinations in Asia continued to fall, with just one vessel signaling a destination in India.

One cargo that was scheduled to load at Primorsk during the week to April 22 appears to have slipped from the program, but most others are loading on schedule. Shipments from Ust-Luga ran to plan.

Eight tankers loaded at Novorossiysk in the Black Sea in the week to April 22, that’s the most ships in any week so far this year. Almost 40% of the crude loaded at the terminal was delivered to Bulgaria or Romania, remaining within the Black Sea. Another 35% is heading to India, with the remainder on ships showing destinations in the Med.

The vessel that loaded the previous week and showed its destination as St Lucia in the Caribbean, began carrying out a ship-to-ship transfer in the waters of Ceuta in the western Mediterranean on Sunday.

Of the four ships that loaded from floating storage facilities at Murmansk, two are heading to Rotterdam, one to Le Havre in France, and the fourth to Omisalj in Croatia.

Almost all of the crude shipments from Russia’s three eastern oil terminals during the week to April 22 went to China. Of 11 tankers that loaded at the three terminals, one completed a ship-to-ship transfer off Yeosu in South Korea on Sunday and a second is heading for Incheon. All of the others are heading to ports in China.

Also Read: Norway Arrests Activists Blocking Tanker with Russian Oil

Three ships headed to Asia from Russia’s western ports in the week to April 22. Another five left without signaling a final destination.

Of those five vessels, one is signaling Suez, one “for orders” and one is still signaling its destination as the port where it loaded. The other two ships are showing their destination as Gibraltar. That’s a common signal for ships heading into the Mediterranean and there are several possibilities once they arrive there. They may deliver to a Mediterranean terminal, they may pass through the Suez Canal and on to Asia, or they may transfer their cargoes to other vessels.

The area off the port of Ceuta, just south of Gibraltar, has become a popular site for ship-to-ship transfers of Russian crude. There are two very large crude carriers, or VLCCs, owned by Vitol Group, the world’s largest independent oil trader, that remained in the area throughout the week.

No ship-to-ship cargo transfers were completed in the week to April 22, but the Elandra Everest began to take a cargo from the Aframax tanker Saetta, on Sunday. There are three other Aframax tankers holding Russian crude that are steaming slowly in the same area and they may discharge their cargoes into the Elandra Everest.

Vitol has said that is will stop trading Russian crude and refined products by the end of the year, with volumes set to “diminish significantly in the second quarter as current term contractual obligations decline.”

Related Book: The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources by Javier Blas

Asian Buyers Try to Back Out of Purchases of Russian Oil Grade

Asian oil refiners are shunning a major export grade from the Russian Far East due to sanctions on a tanker company that ships the cargoes.

Buyers are now trying to back out of purchases of Sokol, which was sold out for May-loading two weeks ago, said people with knowledge of the matter. At least one shipment of the variety for loading in end-May has been canceled, with several other refiners trying to wind back purchases for June, said the people who asked not to be named due to the sensitivity of the information.

Sokol is being avoided due to the involvement of Sovcomflot PJSC, a Russian state-controlled firm that transports the crude produced at the Sakhalin-I project from the De-Kastri export terminal to customers in North Asia. The company’s tankers are struggling to get insurance from international firms after it was added to a list of U.K.-sanctioned entities, the people said.

While many Asian refiners have stepped in to buy Russian oil after it was shunned due to the invasion of Ukraine, the episode illustrates they still need to be careful. Marine insurance is critical for the buyer as well as other shipowners as it provides protection from legal liabilities such as damage to cargoes, collisions and oil spills. A lack of coverage could lead to lawsuits and subject counterparties to hefty losses in the event of an accident.

Exxon Mobil Corp., which operates Sakhalin-I on behalf of an international consortium of Japanese, Indian and Russian companies, didn’t immediately respond to an email seeking comment. The U.S. oil major is seeking to exit the project. A Sovcomflot spokesperson declined to comment.

It’s unclear what will happen to the canceled cargoes. They could be re-offered via closed tenders or stored in onshore tanks. Sokol shipments scheduled for loading in May were sold to buyers across China, South Korea, Japan and India. Russia’s biggest state oil producer Rosneft PJSC failed to award a tender to sell millions of barrels of Urals crude this week.

The Sakhalin-I Sokol stream is one of Russia’s main export grades alongside Urals and ESPO. The variety is popular with refiners in North Asia, Hawaii and even Australia as it produces large quantities of diesel when refined. The crude can travel from De-Kastri to major refining hubs in China and South Korea in just three to five days.

Sovcomflot provides tankers for the Sakhalin-I project as part of a long-term agreement. The shipowner’s vessels load the crude from De-Kastri and carry it to destinations in North Asia. Buyers from further afield need to charter other tankers, which conduct ship-to-ship transfers off South Korea.

The trading of Russian oil is becoming more clandestine due to restrictions over the war in Ukraine. Vitol Group, the world’s biggest independent oil trader, has said that it will stop dealing with Russian crude by the end of the year, while majors such as Shell Plc and Exxon Mobil Corp. are working on divesting their investments and withdrawing from the country.

The Suezmax tanker Matala is continuing its voyage from Murmansk in the Arctic to India. The ship was rounding Sri Lanka on Monday morning and is due to end its 11,000 miles journey at the Indian port of Paradip on Thursday, according to earlier destination signals.

Related Book: The World for Sale: Money, Power and the Traders Who Barter the Earth’s Resources by Javier Blas

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: Bloomberg uses commercial ship-tracking data to monitor the movement of vessels. Ships can avoid detection by turning off on-board transponders, as has been done widely by the Iranian tanker fleet. There is no evidence yet that this is being done by crude oil tankers calling at Russian ports.

Note: Destinations are those signaled by the vessel and are monitored until the cargo is discharged. Destinations may change during a voyage, even under normal circumstances, and the final discharge point for the cargo may not be known until that port is reached.

Note: Cargo volumes are based on loading programs, where those are available, and on a combination of the ship’s capacity and its depth in the water where we have no other information.

By Julian Lee Serene Cheong, Sharon Cho and Debjit Chakraborty with assistance from Ann Koh, Sherry Su and Elaine He. © 2022 Bloomberg L.P.